Objective

This project aims to forecast corporate bond spreads using historical market and macroeconomic data. The analysis demonstrates exploratory data analysis, feature engineering, and multiple time series and machine learning models. The final output highlights a linear regression model with lagged features as an interpretable and robust forecasting tool.

0. Browse Notebooks

| Notebook Link | Description |

|---|---|

| 01_data_collection.ipynb | Data collection and merging |

| 02_EDA.ipynb | Exploratory data analysis and feature engineering |

| 03_Modeling.ipynb | Time series and machine learning modeling, hyperparameter tuning, final model export |

1. Datasets

The dataset includes:

- Corporate bond yields

- 10-year Treasury yields

- VIX (market volatility index)

- CPI (Consumer Price Index)

- Fed Funds rate

The corporate bond spread, our primary target, is calculated as:

Spread = Corporate Bond Yield - 10-Year Treasury Yield

2. Exploratory Data Analysis

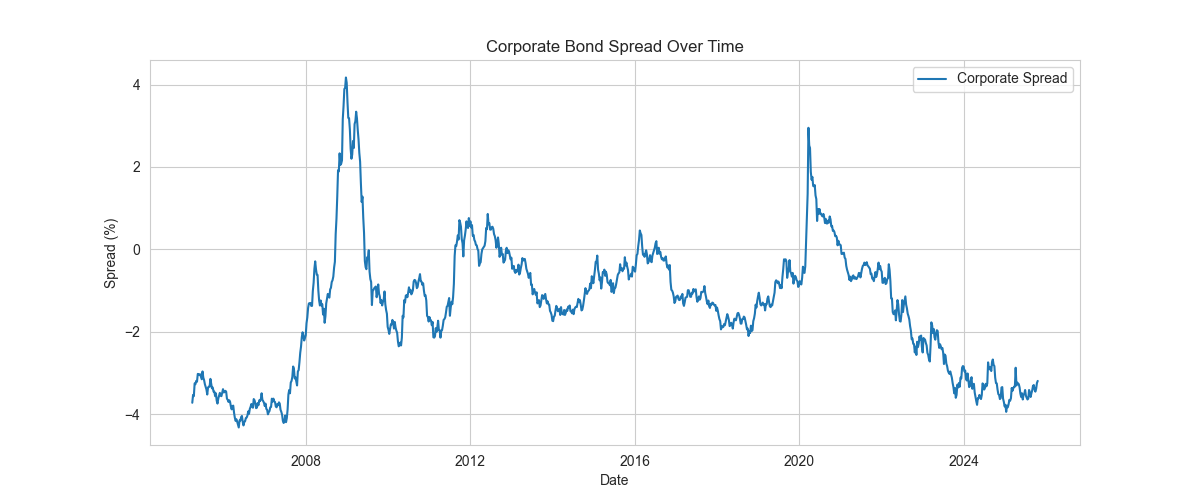

Corporate Spread Over Time

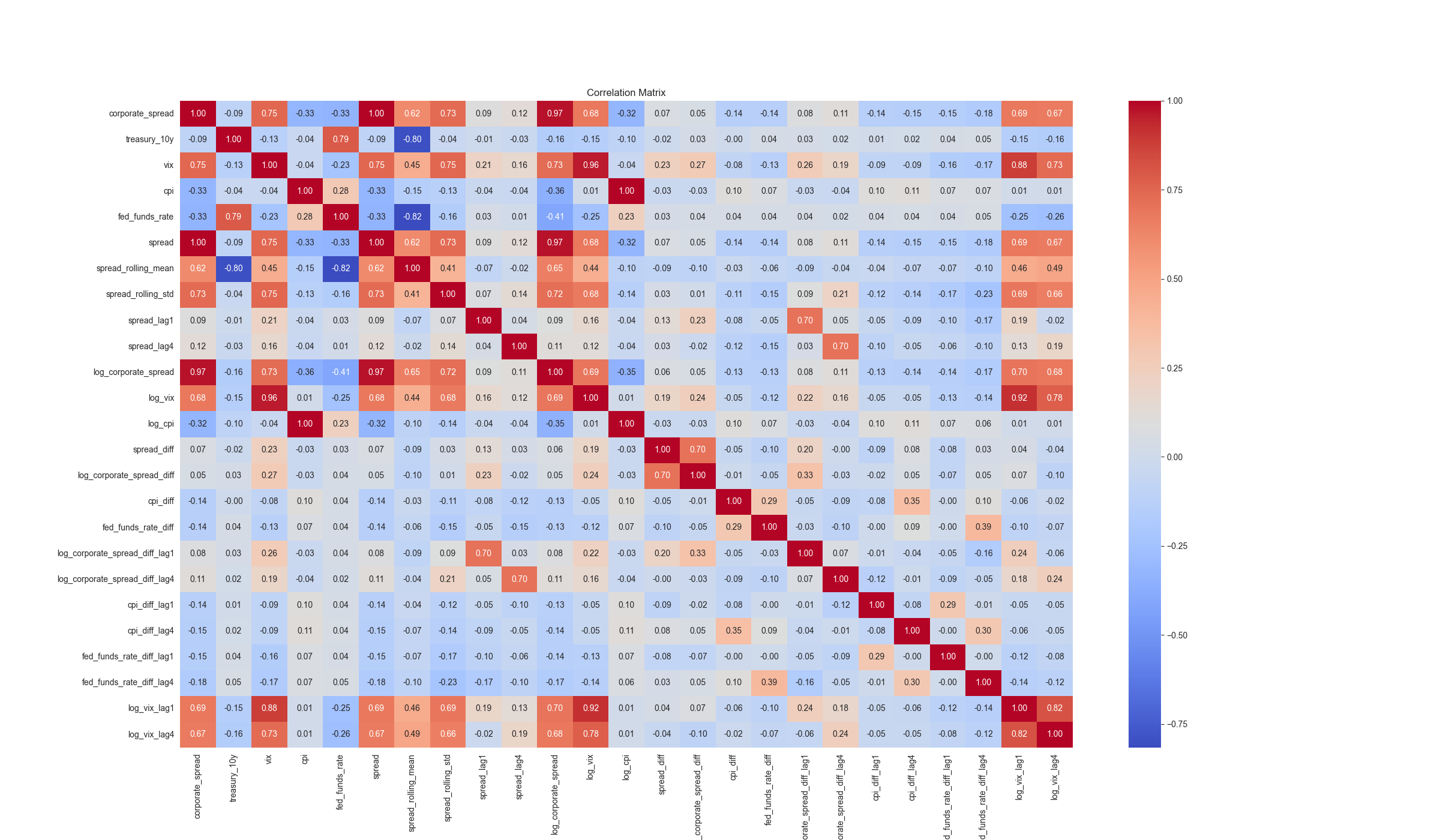

Correlation Structure

3. Forecasting Models

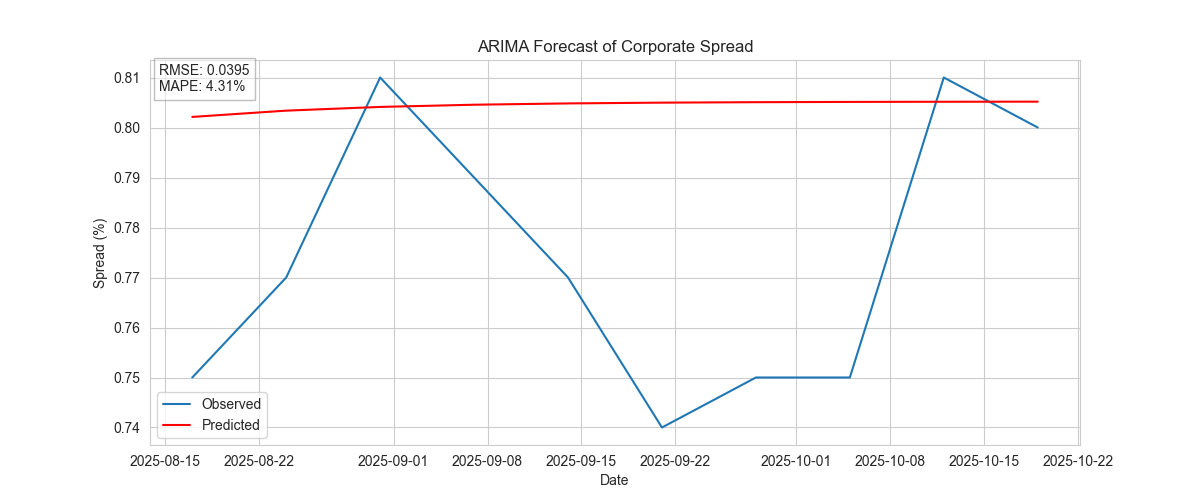

ARIMA

Captures autocorrelation in the spread series.

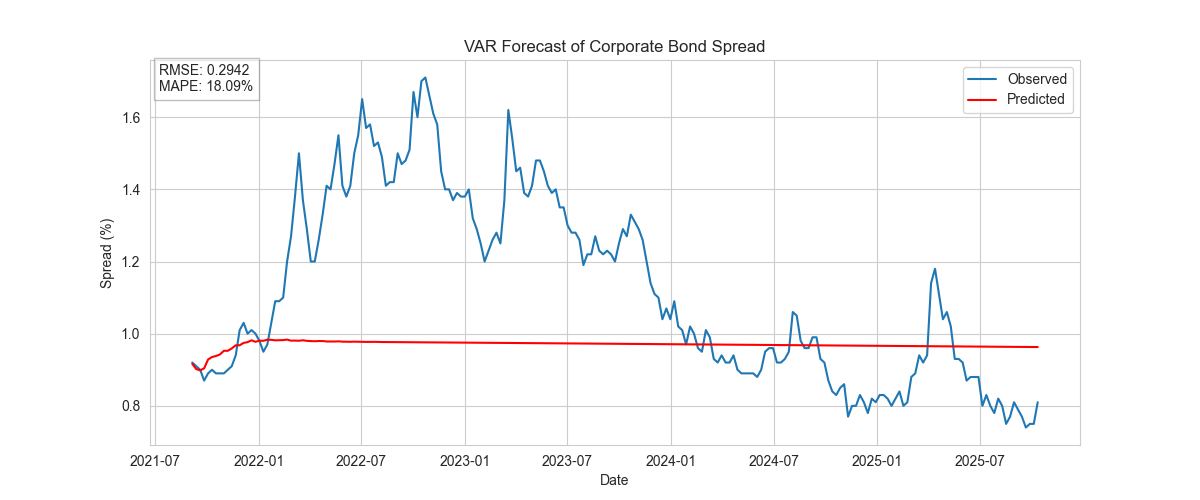

VAR

Incorporates interdependencies between spread and macroeconomic variables.

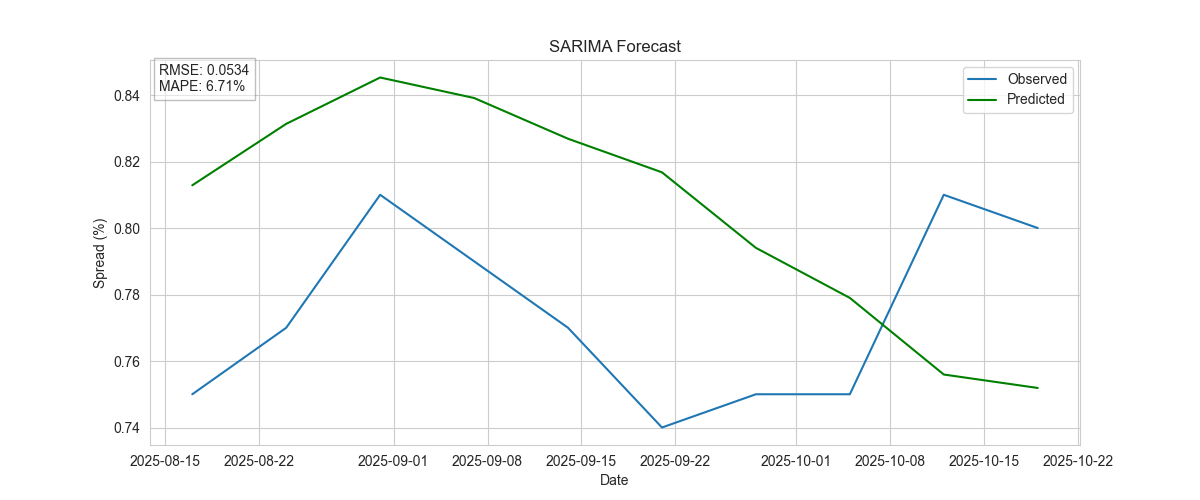

SARIMA

Accounts for potential seasonality in the spread.

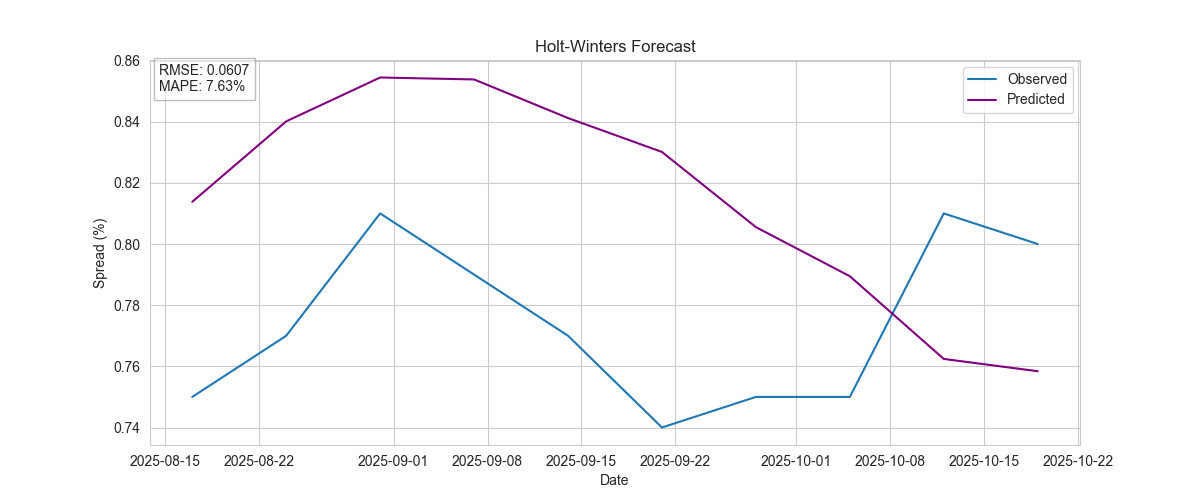

Holt-Winters

Captures both trend and seasonal components for robust forecasting.

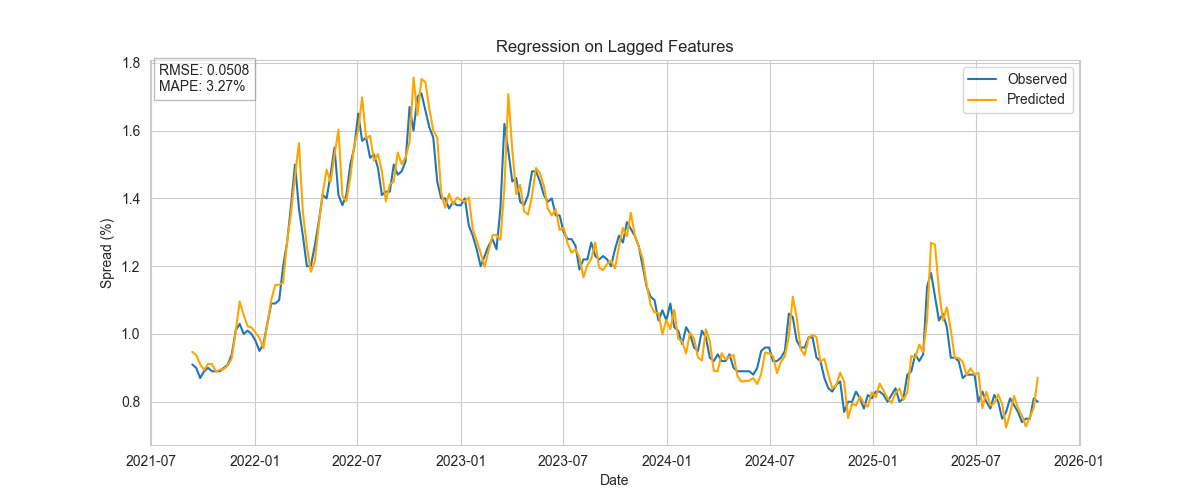

Regression on Lagged Features

Simple linear regression with lagged spreads and macro variables.

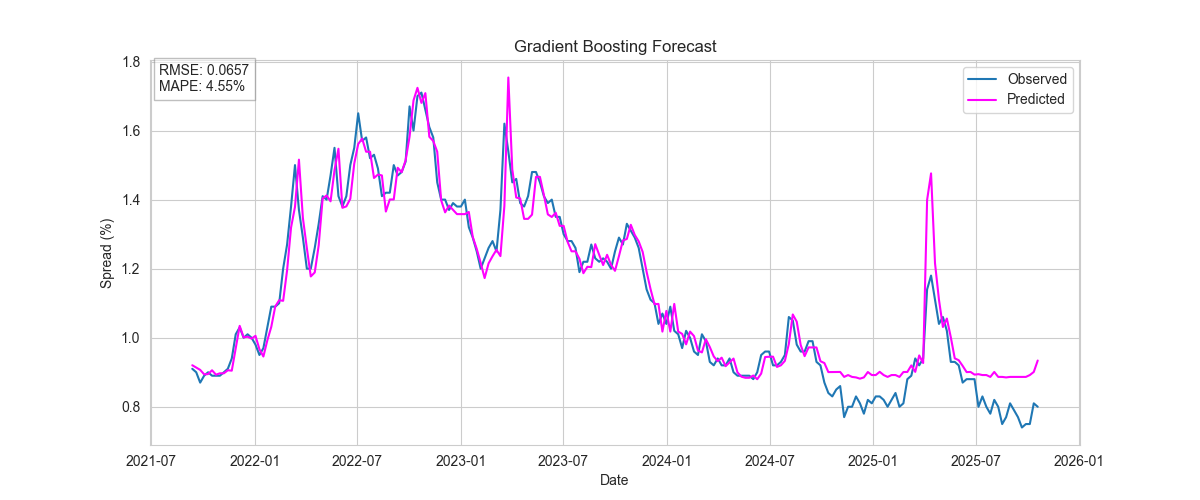

Gradient Boosting

Non-linear tree-based model capturing complex interactions.

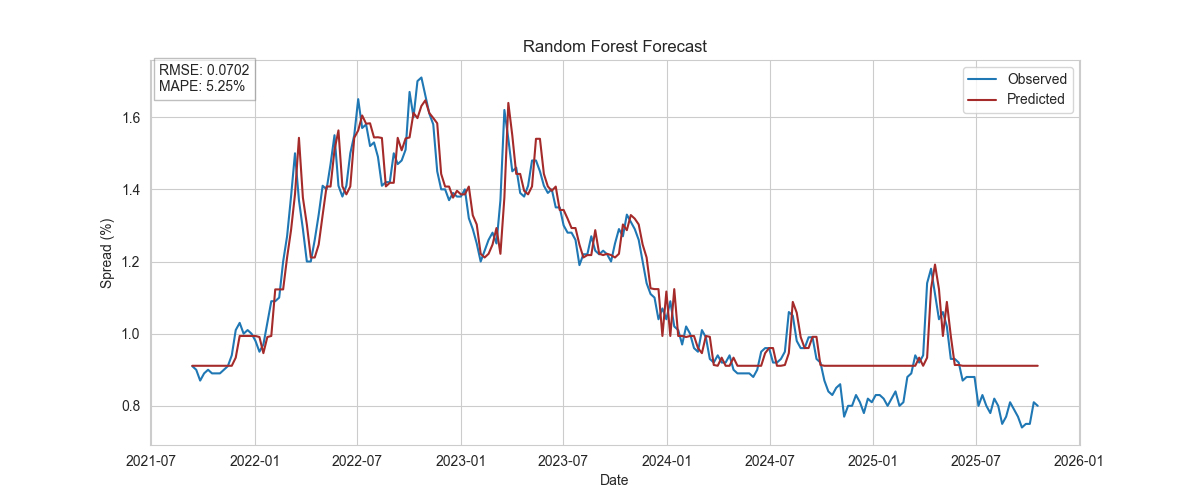

Random Forest

Ensemble model with robust performance and low sensitivity to hyperparameters.

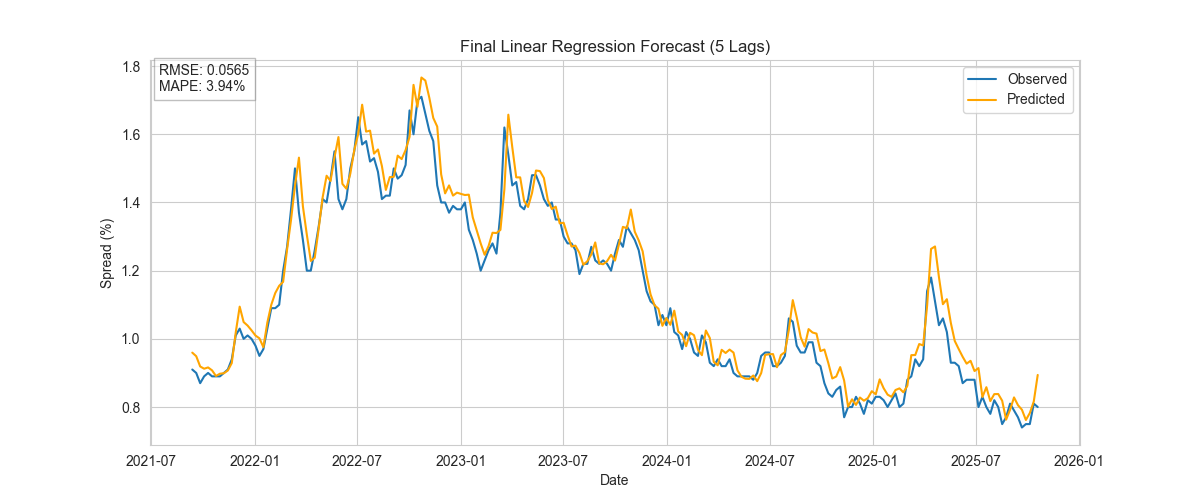

Final Linear Regression Model

Interpretable model using five lagged spreads and macro variables.

4. Feature Contribution

| Feature | Coefficient | Impact |

|---|---|---|

| spread | 0.9594 | 1.6013 |

| log_vix | 0.1356 | 0.3959 |

| cpi | -0.00016 | -0.0372 |

| fed_funds_rate | 0.00568 | 0.00734 |

Interpretation: Lagged spreads dominate the forecast, reflecting strong autocorrelation. VIX contributes meaningfully to risk adjustments. CPI and Fed Funds rate have minor short-term influence.

5. Model Evaluation

Models are evaluated using root mean squared error (RMSE) and mean absolute percentage error (MAPE).

- RMSE quantifies the average magnitude of forecast errors, penalizing larger deviations.

- MAPE expresses errors as a percentage, providing an intuitive measure of forecast accuracy across varying scales.

These metrics are standard in quantitative finance for short-term risk and spread forecasting.

Key Observations:

- Linear regression with lagged features outperforms more complex tree-based and ARIMA models in rolling out-of-sample validation.

- Walk-forward validation provides a realistic estimate of forecast performance, avoiding data leakage.

6. Project Artifacts

Notebooks

| Notebook | Description | Path |

|---|---|---|

01_data_collection.ipynb | Data collection and merging | Notebooks/01_data_collection.ipynb |

02_EDA.ipynb | Exploratory data analysis and feature engineering | Notebooks/02_EDA.ipynb |

03_Modeling.ipynb | Time series and machine learning modeling, hyperparameter tuning, final model export | Notebooks/03_Modeling.ipynb |

Models and Outputs

| File | Description | Path |

|---|---|---|

final_lr_model.pkl | Trained linear regression model | model/final_lr_model.pkl |

feature_impact.csv | Feature contribution table | model/feature_impact.csv |

predictions.csv | Observed vs predicted spreads for test period | model/predictions.csv |

7. Insights and Takeaways

Feature Engineering

Lagged spreads and macroeconomic transformations are critical for accurate short-term forecasting.Model Selection

Linear models offer interpretability and stability; tree-based and ARIMA models may require more data or hyperparameter tuning.Interpretability

Coefficients provide actionable insights into which features drive spreads, supporting quantitative risk management decisions.Robust Forecasting

Walk-forward validation ensures models generalize to unseen data, providing a realistic measure of prediction risk.

8. Conclusion

An interpretable linear regression model with well-engineered lag features provides robust short-term forecasts for corporate bond spreads. While complex models capture non-linearities, the linear approach balances accuracy, stability, and interpretability, aligning with quantitative risk management objectives.

All plots, forecasts, notebooks, and model artifacts are included above for full transparency of methodology and results.